Let’s be honest. Tax season can feel like navigating a maze blindfolded, especially when your “office” is a laptop in a coffee shop and your income streams from a patchwork of platforms. You’re not just a freelancer anymore—you’re a modern solopreneur, leveraging tools like Upwork, Fiverr, Shopify, and a dozen SaaS subscriptions to build your empire. That complexity? It’s your superpower. But it also rewrites the rulebook for tax deductions and compliance.

Here’s the deal: the old tax guides barely scratch the surface. We need to talk about the real, often-overlooked deductions your digital toolkit unlocks, and how to stay compliant without losing your mind. Let’s dive in.

Your Digital Toolbox is a Tax Deduction Goldmine

Think about your monthly subscriptions. Every tool that helps you run, market, or manage your business is likely deductible. But are you catching them all?

Beyond the Obvious: SaaS & Platform Costs

Sure, you know about accounting software. But what about:

- Platform Fees & Commissions: That 20% cut Upwork takes? The transaction fee on Etsy? Deductible business expense. Track it.

- Productivity & Collaboration SaaS: Notion, Slack, Asana, Canva Pro, Zoom—if it’s for business, it counts.

- Cloud Storage & Hosting: Google Workspace, Dropbox, your website hosting. Essential utilities for a digital business.

- Learning & Development: That Coursera course on SEO? The subscription to a niche industry newsletter? If it maintains or improves your required skills, it’s potentially deductible.

Honestly, the list is vast. A good rule of thumb: if it makes you money, saves you time, or is required to operate, flag it. The key is meticulous tracking—which, thankfully, other SaaS tools can help with.

The Home Office Deduction, Reimagined for the Nomad

This one’s a classic, but it’s changed. If you have a dedicated room, you can use the simplified method. But what if you’re a true digital nomad or just work from your kitchen table?

Well, you can still deduct a portion of rent, utilities, and internet based on the space and time used exclusively for business. It’s trickier, but vital. And that leads to another huge point: your internet and cell phone bills. You use them for business, right? A percentage is deductible. Just be reasonable—claiming 90% might raise an eyebrow if it’s also your streaming device.

Compliance: The Not-So-Secret Burden of Platform Work

This is where many solopreneurs get tripped up. Gig platforms issue 1099-K forms, but the thresholds have been a moving target. The IRS delayed the $600 reporting rule, but the responsibility to report all income hasn’t changed. Not one bit.

You must report income from every platform, even if you don’t get a form. It’s a pain, I know. But consider this: clean, auditable records are your best defense and your path to maximizing those deductions we just talked about.

Quarterly Estimated Taxes: Don’t Get Caught Out

This might be the biggest compliance shock for new solopreneurs. When you work for yourself, no one withholds taxes. You’re expected to pay as you earn, in quarterly estimated tax payments. Miss these, and you could face penalties.

It feels daunting. But setting aside 25-30% of each payment you receive from Fiverr, Patreon, or your Shopify store in a separate savings account can make it manageable. It’s not your money—it’s the IRS’s. Thinking of it that way helps.

Organizing Your Financial Chaos: A Practical System

You can’t deduct what you can’t document. Here’s a simple, human-friendly system:

- Open a Separate Business Bank Account. Seriously. Mixing personal and business finances is a recipe for audit anxiety and missed deductions.

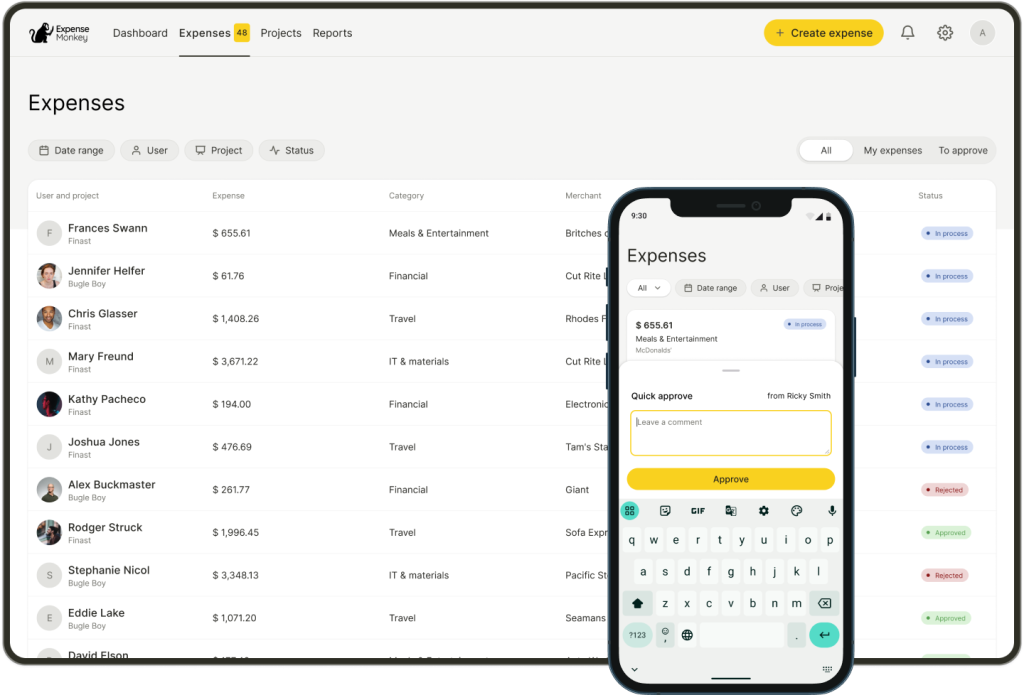

- Use a Dedicated Tool. Apps like QuickBooks Self-Employed, FreshBooks, or even Expensify can link to your accounts and auto-categorize transactions. They also track mileage and capture receipt images.

- Do a Weekly 15-Minute Money Review. Every Friday, log in, reconcile transactions, and tag anything unclear. It’s less overwhelming than a quarterly scramble.

This system turns tax time from a forensic accounting nightmare into a simple review.

Common Pitfalls to Sidestep

Even with the best intentions, mistakes happen. Here are a few to watch for:

| Pitfall | The Smart Fix |

| Claiming 100% of a device used for both Netflix and client work. | Calculate a realistic business-use percentage. 70%? 60%? Be prepared to justify it. |

| Forgetting about smaller, recurring SaaS charges. | Use a virtual credit card for all subscriptions. One statement tells the whole story. |

| Ignoring local taxes & licenses. | Check if your city or state requires a business license or has a gross receipts tax. Compliance is multi-layered. |

| Deducting “fun” as networking. | Be cautious. A business lunch? Solid. A general night out? Not so much. The line matters. |

Wrapping Up: Empowerment Through Clarity

Look, taxes will never be… fun. But for the modern solopreneur, they’re more than a chore—they’re a lens into the financial health of your venture. Every deduction you properly claim is a reinvestment in your own growth. Every compliance box you tick is a layer of professional legitimacy.

In fact, the very tools that make this solo journey possible also hold the key to mastering its financial side. It’s about shifting your mindset from seeing tax work as a frustrating obligation to viewing it as an integral, strategic part of your operation. A part that, when handled with a bit of savvy and the right systems, ensures the empire you’re building is on solid ground—coffee shop Wi-Fi and all.

More Stories

Estate and Inheritance Tax Planning for Blended Families and Non-Traditional Heirs

Sustainable Living Tax Credits and Deductions: Your Guide to Eco-Friendly Home Upgrades

Cryptocurrency and NFT Tax Reporting for Decentralized Finance Users